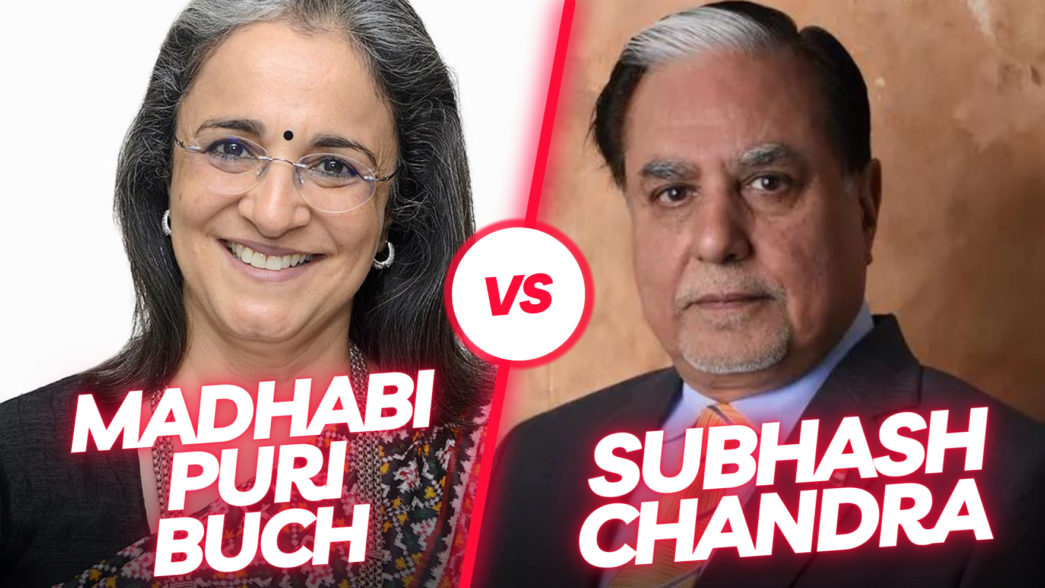

New Delhi: In a dramatic press conference on Monday, September 2, Essel Group Chairman Dr. Subhash Chandra leveled serious allegations against the Securities and Exchange Board of India (SEBI) Chairperson, Madhabi Puri Buch. Chandra claimed that Buch has been acting as a “negative force” against his media conglomerate and accused her of corruption and bias in the handling of the ZEE-Sony merger.

Chandra announced his intention to challenge Buch’s position in court, seeking her removal from SEBI. He stated, “I am not going to cooperate with SEBI. I am rather going to approach the court against her and seek her removal from the position at the earliest possible.”

The crux of Chandra’s allegations revolves around the failed ZEE-Sony merger. He accused Buch of being a key reason behind the deal’s collapse and cited several instances of alleged bias and corruption on her part. Chandra claimed that Buch and her husband had received substantial financial benefits from various corporates and stock market operators, raising questions about her impartiality.

ALSO READ: Warner Bros. Discovery Promotes Harshit Sahni to Cluster Revenue Head

Chandra also alleged that he had been approached by a person who offered to resolve the issues with SEBI through Buch and her husband for a hefty sum. He claimed that the revelations against Buch in recent months had led him to believe that this was indeed a common practice at SEBI.

The allegations against Buch come at a time when SEBI is already facing scrutiny over its handling of the ZEE-Sony merger. In August 2023, SEBI barred Zee promoters Punit Goenka and Subhash Chandra from holding significant management roles within Zee companies or the merged entity.

In response to Chandra’s allegations, SEBI has not yet issued a formal statement. However, it is expected that the regulator will respond to the serious charges leveled against its chairperson.

The legal battle between Subhash Chandra and SEBI is likely to be closely watched by the business community and investors, as it could have far-reaching implications for the regulatory landscape in India.