New Delhi: Google’s parent company, Alphabet, reported a positive second quarter for 2024, with revenue climbing 14% year-over-year to a staggering $84.74 billion. This growth was fueled by a continued surge in advertising sales and a significant jump in its cloud computing business.

Advertising Strengthens with Major Events

Advertising remains Alphabet’s bread and butter, with total ad revenue raking in $64.6 billion, an 11% increase compared to the same period last year. This growth can be attributed partly to major events like the Paris Olympics and elections in several countries, including the US. These high-profile events typically attract a significant amount of advertising spending. YouTube, a dominant platform for video advertising, also saw its ad sales climb 13% to $8.67 billion.

Cloud Computing: A Booming Business

Beyond advertising, Alphabet’s cloud computing division, Google Cloud, emerged as a major growth driver this quarter. Revenue from cloud services skyrocketed by a significant 28.8% to $10.35 billion. This marks a crucial milestone for Google Cloud, as it surpasses the $10 billion quarterly revenue mark for the first time. This growth suggests a potential recovery in enterprise spending on technology, signifying a positive trend for Alphabet’s software business.

ALSO READ: Government Allocates Rs 1,089 Crore for Public Communication in Budget 2024-25

Mixed Investor Reaction, But Optimistic Outlook

Investors initially responded positively to the report, with shares rising by about 2%. However, the reaction was short-lived, with shares dipping by a similar amount shortly after. Despite the mixed reaction, Alphabet remains confident. The company’s strong performance in Search and the momentum in Cloud paint a promising picture for the future.

Focus on Innovation and Growth

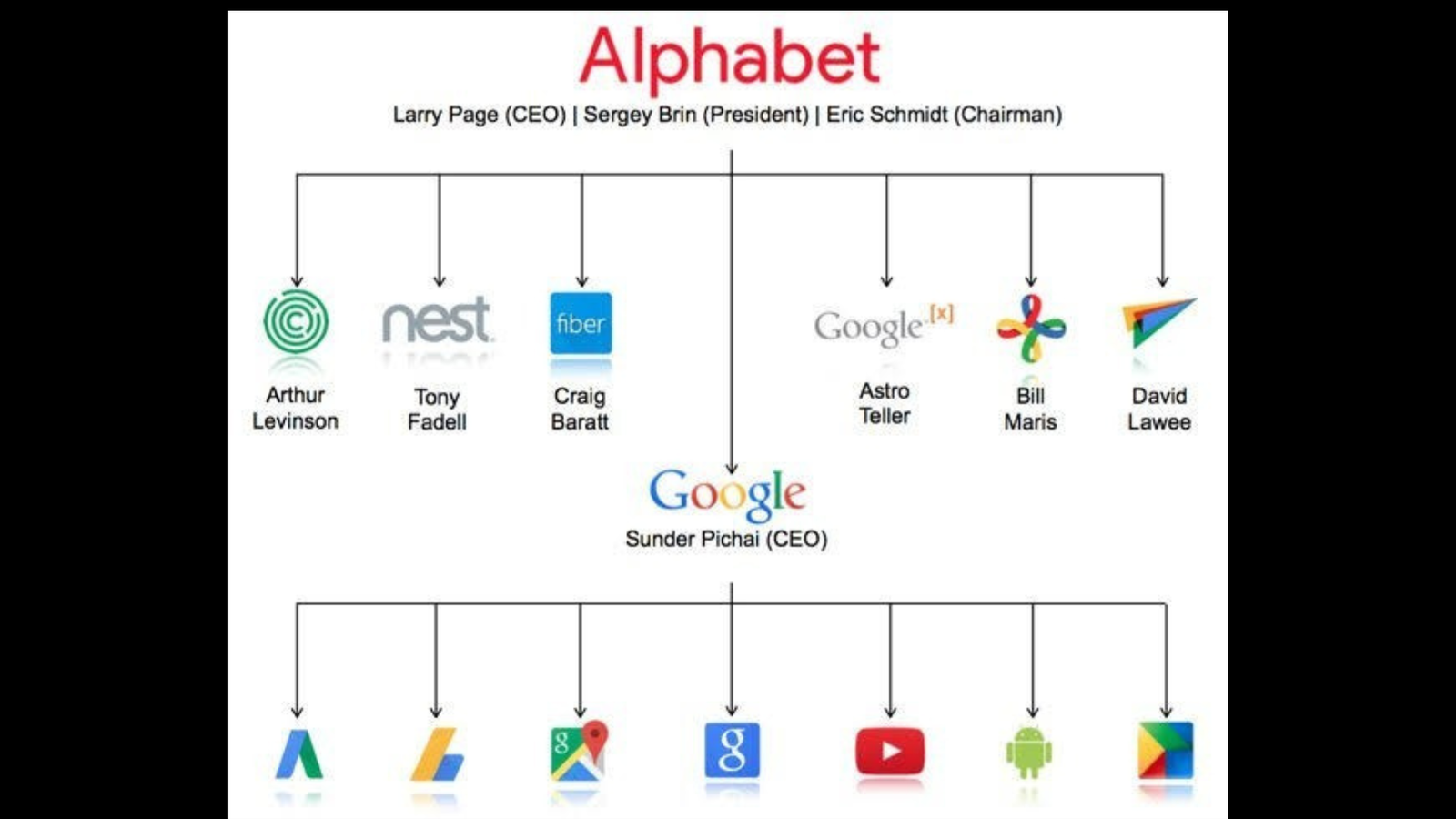

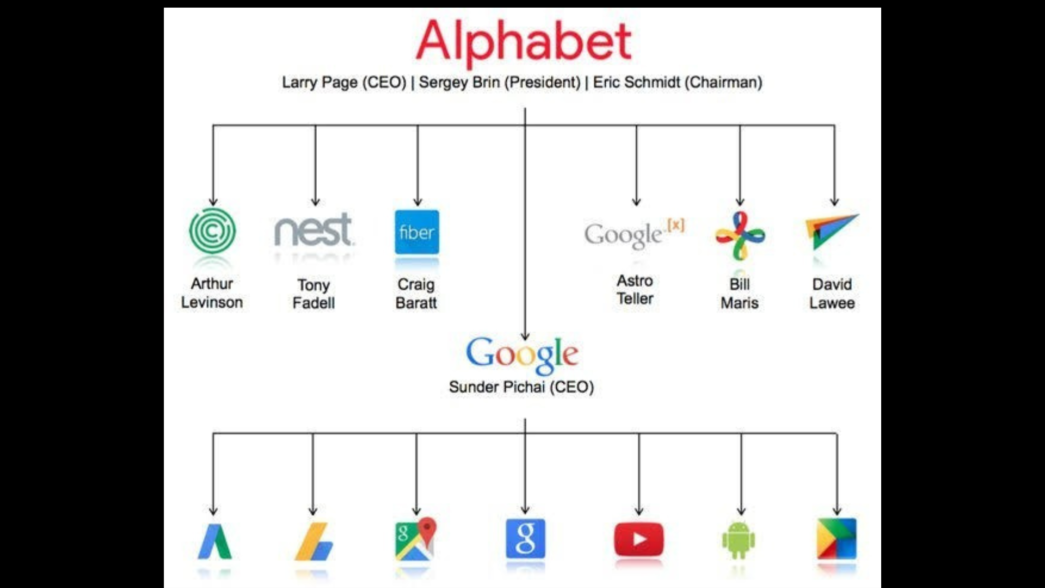

Sundar Pichai, CEO of Alphabet, emphasized the company’s commitment to innovation across all aspects of artificial intelligence (AI). He highlighted Alphabet’s strong foundation in infrastructure and research, positioning them well for future technological advancements.

Ruth Porat, Alphabet’s CFO, echoed this sentiment, stating that the company prioritizes investing in its high-growth opportunities while actively working to manage costs. This focus on innovation and responsible financial management suggests that Alphabet is well-equipped to capitalize on the numerous opportunities that lie ahead.